Trade Setup for Monday: Top 15 things to know before Opening Bell

Any upside bounce up to 11,350-11,400 could be a sell on rise opportunity in the market, Nagaraj Shetti of HDFC Securities said.

The market snapped six-day losing streak and rebounded sharply to close above 11,000 on the Nifty with more than 2 percent gains on September 25, the first day of October series. The reports of likely stimulus package from government ahead of festive season lifted sentiment.

The BSE Sensex surged 835.06 points or 2.28 percent to 37,388.66, driven by rally across sectors.

The Nifty50 climbed 244.80 points or 2.27 percent to 11,050.30 and formed bullish candle on the daily charts, but lost 4 percent for the week and witnessed bearish candle formation on the weekly scale.

"The larger up move as per the positive sequence of higher tops and bottoms has been broken recently and Nifty shifted into a downward corrective action by the way of lower tops and bottoms in the last couple of weeks. Hence, last Thursday's low of 10,790 could be considered as a new lower bottom of the sequence and Friday's upmove could be a considered as a part of new lower top. Hence, further upside can't be ruled out by early next week before showing another round of weakness from the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

Any upside bounce up to 11,350-11,400 could be a sell on rise opportunity in the market and the expected decline from the highs could retest the lower 10,800 levels in the near term, he said, adding immediate support is placed at 10,900.

The broader markets too participated in the run, with the Nifty Midcap and Smallcap indices rising nearly 3 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 10,912.46, followed by 10,774.73. If the index moves up, the key resistance levels to watch out for are 11,130.26 and 11,210.33.

Nifty Bank

The Bank Nifty also rallied 525.50 points or 2.57 percent to close at 20,982.35 and formed bullish candle on the daily charts on September 25. The important pivot level, which will act as crucial support for the index, is placed at 20,587.23, followed by 20,192.17. On the upside, key resistance levels are placed at 21,220.84 and 21,459.37.

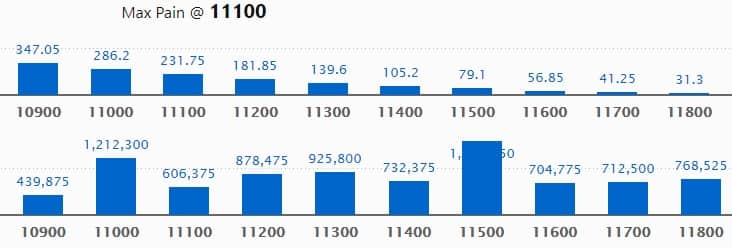

Call option data

Maximum Call open interest of 15.78 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the October series.

This is followed by 11,000 strike, which holds 12.12 lakh contracts, and 11,300 strike, which has accumulated 9.25 lakh contracts.

Call writing was seen at 11,300 strike, which added 74,775 contracts, followed by 10,800, which added 68,175 contracts, and 11,500 strike, which added 61,350 contracts.

Call unwinding was seen at 11,000 strike, which shed 24,975 contracts, followed by 10,500 strike, which shed 825 contracts.

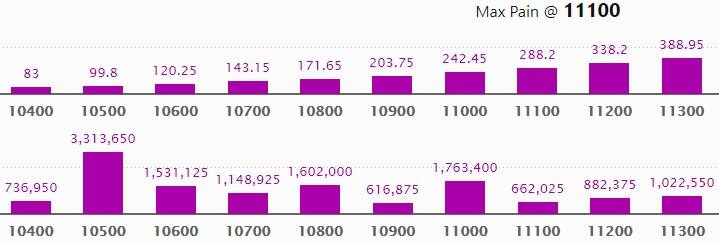

Put option data

Maximum Put open interest of 33.13 lakh contracts was seen at 10,500 strike, which will act as crucial support in the October series.

This is followed by 11,000 strike, which holds 17.63 lakh contracts, and 10,800 strike, which has accumulated 16.02 lakh contracts.

Put writing was seen at 10,500 strike, which added 2.77 lakh contracts, followed by 10,600 strike, which added 2.53 lakh contracts and 10,800 strike which added 1.77 lakh contracts.

Put unwinding was witnessed at 11,200 strike, which shed 25,200 contracts, followed by 11,400 strike which shed 14,550 contracts and 11,600 strike which shed 4,950 contracts.

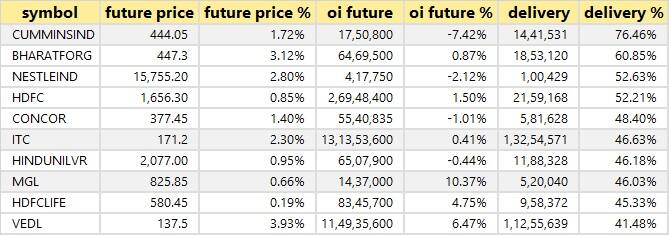

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

90 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

1 stock saw long unwinding

Based on the open interest future percentage, here is the 1 stock in which long unwinding was seen.

![]()

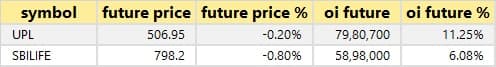

2 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 2 stocks in which short build-up was seen.

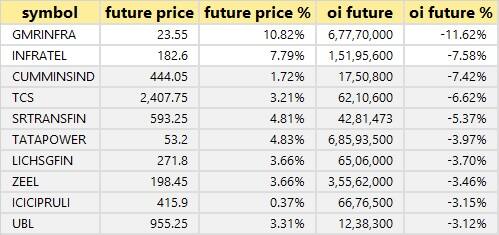

44 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

Bulk deals

Eris Lifesciences: Kuwait Investment Authority A/C Kuwait Investment Authority Fund 225 acquired 14,54,175 shares in company at Rs 540 per share. However, Himanshu Jayantbhai Shah sold 18 lakh shares at Rs 540.05 per share on the NSE.

(For more bulk deals, click here)

Analysts/Board Meetings

Symphony: Company's officials will hold conference call with ENAM Securities on September 28.

Advanced Enzyme Technologies: Company's officials to attend virtual meet on September 29-30 for interaction with Motilal Oswal 2nd Annual India Ideation Conference.

IRB Infrastructure: Company's officials to attend virtual meet on September 28-30 for interaction with Motilal Oswal 2nd Annual India Ideation Conference.

Orient Electric: Company's officials to attend virtual meet on September 28 for interaction with Motilal Oswal 2nd Annual India Ideation Conference.

Tata Motors: Company's officials will hold conference call with Fidelity International on October 1.

Tata Steel: Company's officials will hold conference call with Pinpoint Asset Management on September 29.

ISGEC Heavy Engineering: Company's officials will hold virtual conference call with analysts on September 29.

Arihant Capital Markets: Board will hold a meeting on October 3 to make investment in other company upto 49% of share capital and disinvestment/sale of wholly owned subsidiary company.

Manappuram Finance: Company is considering various options for raising funds in October.

ICICI Bank: Board on October 31 to consider unaudited financial results for the quarter and half-year ending September 2020.

Stocks in the news

NALCO: Company signed MoU with Numaligarh refinery for long-term supply of CP coke.

JSW Energy: Subsidiary JSW Solar received Letter of Award for total blended wind capacity of 810 MW, from Solar Energy Corporation.

Central Bank of India: Bank closed its QIP by raising Rs 255 crore, set issue price at Rs 15.38 per share.

NCL Industries: The JV deal with China's Qingdao Xinguangzheng Steel Structure Company terminated as current state of bilateral relations between India & China is not conducive for the JV.

Thomas Cook: Board approved withdrawal of buyback of shares due to undergone substantial deterioration on account of the pandemic, global lockdowns.

Sequent Scientific: Company completed sale of investments held in Strides Pharma Science.

Grasim Industries: LIC increased stake in company to 11.86% from 9.83% earlier.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,080.21 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 2,070.63 crore in the Indian equity market on September 25, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Not a single stock is under the F&O ban for September 28. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Comments

Post a Comment