Trade Setup for Monday

According to pivot charts, the key support levels for the Nifty is placed at 11,439.37, followed by 11,373.73.

The market lost momentum in last hour of trade amid mixed global cues on September 18 as bears turned strong due to selling pressure in banking & financials though hefty buying in pharma stocks capped losses to some extent.

The BSE Sensex was down 134.03 points to close at 38,845.82, while the Nifty50 fell 11.10 points to 11,505 and formed Bearish Belt Hold kind of pattern on daily charts. For the week, it gained 0.4 percent and witnessed Doji kind of formation on weekly scale.

Experts see rangebound movement in coming sessions and advise investors to stay cautious given the profit booking taking place on every rise.

"Nifty continued to rest on the support of 200-day EMA and has failed to show any significant upside bounce from there. We observe 7-8 sessions of range movement on the daily chart and that has eventually resulted in a downside breakouts, after opening highs for few occasions and upside breakouts have failed to sustain. Hence, one needs to be cautious about 1-2 range movements and any sell on rise (from new swing highs)," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"A Doji or a high wave type candle pattern was formed on the weekly chart. Nifty shifted into a minor upside bounce after the formation of crucial reversal pattern like bearish engulfing pattern on week before last, as per weekly chart. Hence, as long as the high of this pattern is protected at 11,800 levels, we are unlikely to see any sustainable upside bounce in the near term," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,439.37, followed by 11,373.73. If the index moves up, the key resistance levels to watch out for are 11,577.37 and 11,649.73.

Nifty Bank

The Bank Nifty corrected 289.35 points or 1.30 percent to 22,031 on September 18, underperforming Nifty50. The important pivot level, which will act as crucial support for the index, is placed at 21,720.87, followed by 21,410.63. On the upside, key resistance levels are placed at 22,405.37 and 22,779.63.

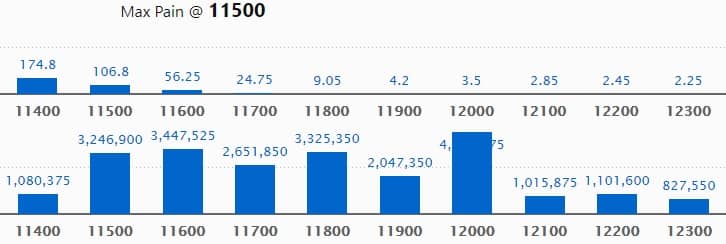

Call option data

Maximum Call open interest of 43.90 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the September series.

This is followed by 11,600 strike, which holds 34.47 lakh contracts, and 11,800 strike, which has accumulated 33.25 lakh contracts.

Call writing was seen at 12,000 strike, which added 9.77 lakh contracts, followed by 11,800, which added 8.21 lakh contracts, and 11,600 strike, which added 5.3 lakh contracts.

Call unwinding was seen at 11,300 strike, which shed 53,775 contracts, followed by 11,000 strike, which shed 14,475 contracts.

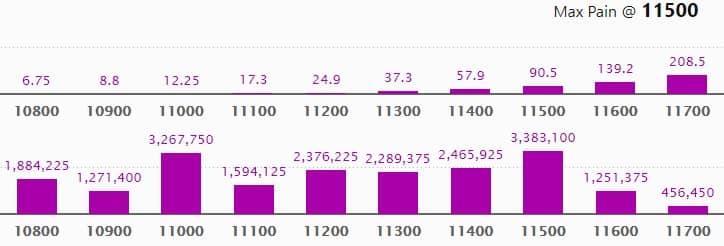

Put option data

Maximum Put open interest of 33.83 lakh contracts was seen at 11,500 strike, which will act as crucial support in the September series.

This is followed by 11,000 strike, which holds 32.67 lakh contracts, and 11,400 strike, which has accumulated 24.65 lakh contracts.

Put writing was seen at 11,200 strike, which added 4.08 lakh contracts, followed by 10,900 strike, which added 2.29 lakh contracts and 11,500 strike which added 1.97 lakh contracts.

Put unwinding was witnessed at 11,600 strike, which shed 70,800 contracts, followed by 12,000 strike which shed 44,625 contracts.

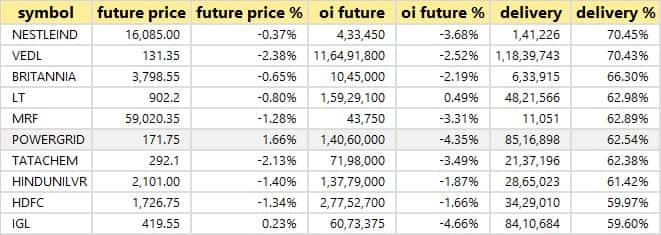

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

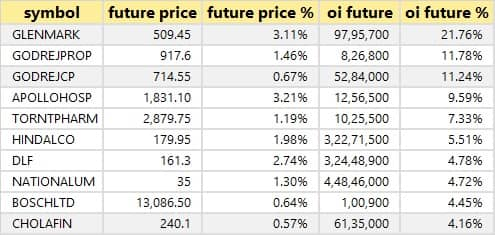

19 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

46 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

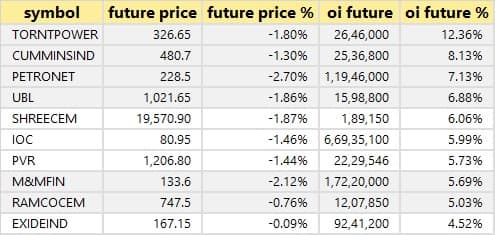

36 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

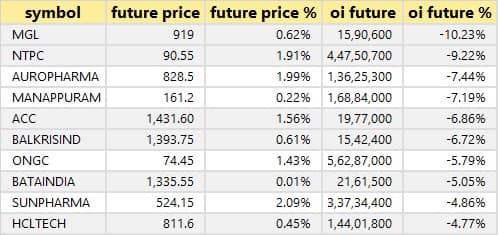

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

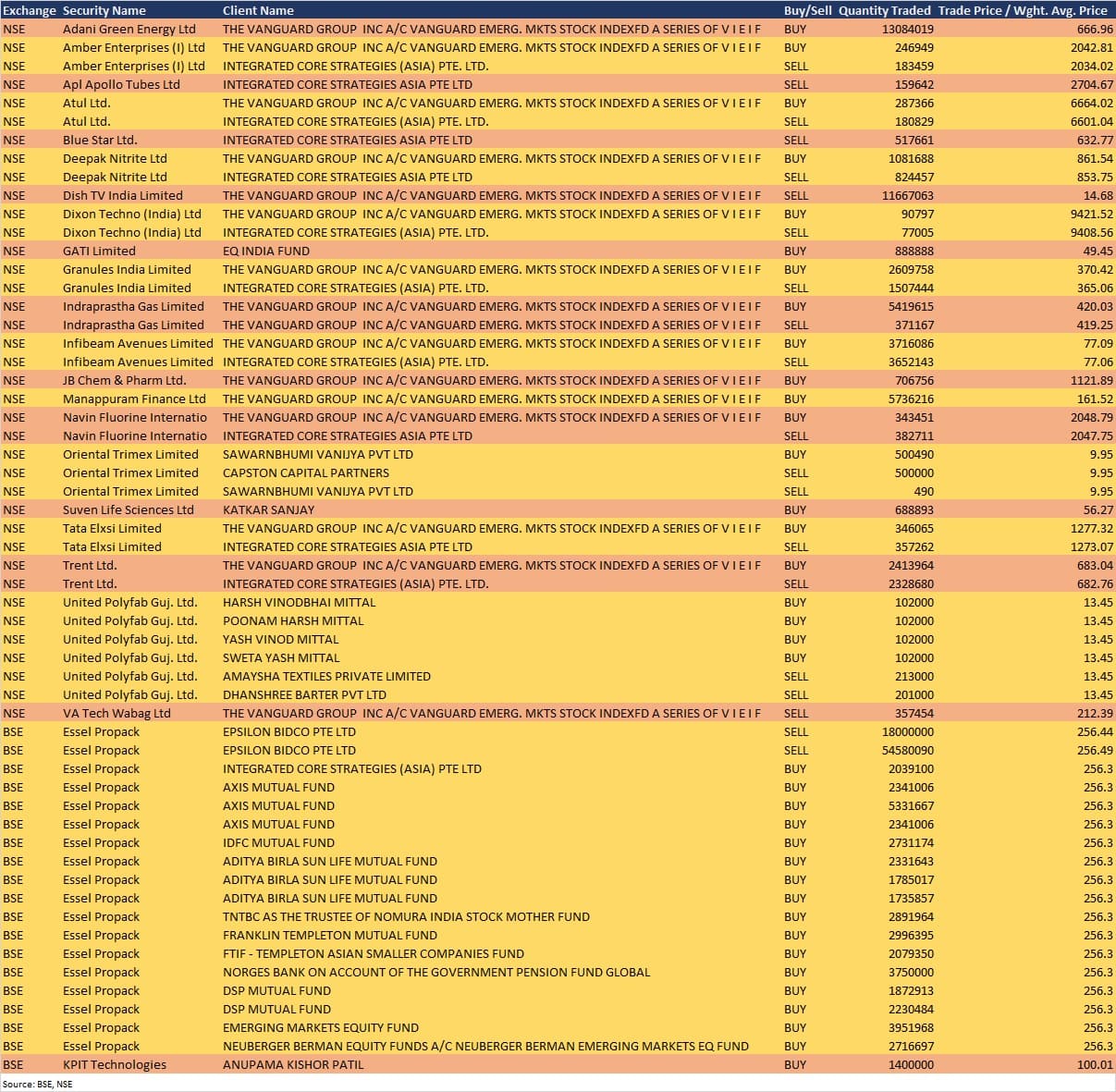

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Tata Motors: Company declared its schedule of meetings with the Analyst / Institutional Investors from September 21 to September 25, 2020.

Shriram City Union Finance: Company's representatives will have conference call with Fidelity International, and Ruane, Cunniff and Goldfarb, Inc on September 21.

Jindal Saw: Its 35th Annual General Meeting to be held on September 25.

Dixon Technologies: Company's representatives will be meeting JP Morgan and Copper Rock Capital on September 21, and USS on September 22.

Stocks in the news

Seamac: Promoter entities HAL Offshore Ltd & PACs acquired 60,000 shares in company, increasing stake to 69.80%.

RITES: Company announced buyback of shares up to Rs 257 crore at a price of Rs 265 per share and has fixed September 30 as record date for the purpose of buyback.

JSW Steel: Urmila Bhuwalka released 40,000 pledged shares.

Chemcon Speciality Chemicals: Its 318-crore IPO will open on September 21 and close on September 23. Price band is fixed at Rs 338-340 per share.

Computer Age Management Services: Its 2,244-crore IPO will open on September 21 and close on September 23. Price band is fixed at Rs 1,229-1,230 per share.

Rushil Decor: Company will open its rights issue of Rs 24.89 crore on September 21.

Chambal Fertilisers & Chemicals: Promoter entity Zuari Global created a pledge on 2.5 lakh shares.

Allcargo Logistics: Sheetal Gulati has resigned as Group Chief Financial Officer of the company.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 205.15 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 100.83 crore in the Indian equity market on September 18, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Ten stocks -- Adani Enterprises, BHEL, Canara Bank, Glenmark Pharma, Vodafone Idea, Jindal Steel & Power, L&T Finance Holdings, SAIL, Tata Chemicals and Vedanta-- are under the F&O ban for September 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Comments

Post a Comment