Trade Setup for Thursday

The market on September 16 continued its uptrend for the second consecutive session with the Nifty reclaiming the 11,600 mark for the first time since August 28, backed by buying in almost all sectors.

The BSE Sensex climbed 258.50 points to close at 39,302.85, while the Nifty50 rose 82.70 points to 11,604.50 and formed a bullish candle on the daily charts.

"Nifty moved above the crucial overhead resistance around 11,580 and closed higher (previous opening downside gap of September 4 and the uptrend line, connecting previous rising lows). This action could bring hopes for bulls and one may expect Nifty to test the next upside levels of 11,795 in the near term (high of long bear candle of August 31)," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"After the formation of the Bearish Engulfing pattern on the daily and weekly chart, the Nifty has failed to show any significant decline in the last 8-10 sessions. Wednesday's attempt to move above the key overhead resistance could be another indication to raise doubt on the sharp negative implication post Bearish Engulfing pattern," he said.

The Nifty Pharma and Realty gained the most among sectors, rising over 2 percent each, while Nifty Auto was up 1.5 percent, followed by Bank, FMCG and IT indices which gained around half a percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,541.5, followed by 11,478.5. If the index moves up, the key resistance levels to watch out for are 11,642.8 and 11,681.1.

Nifty Bank

The Bank Nifty underperformed Nifty50, climbing 107.85 points to close at 22,573.50 on September 16. The important pivot level, which will act as crucial support for the index, is placed at 22,306.93, followed by 22,040.27. On the upside, key resistance levels are placed at 22,749.83 and 22,926.07.

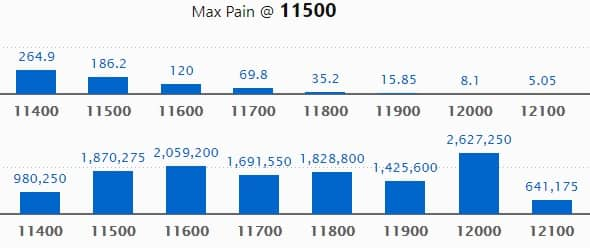

Call option data

Maximum Call open interest of 26.27 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the September series.

This is followed by 11,600 strike, which holds 20.59 lakh contracts, and 11,800 strike, which has accumulated 18.28 lakh contracts.

Call writing was seen at 11,900 strike, which added 3.39 lakh contracts, followed by 11,600, which added 3.10 lakh contracts, and 11,700 strike, which added 2.4 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 1.5 lakh contracts, followed by 11,400 strike, which shed 1.12 lakh contracts.

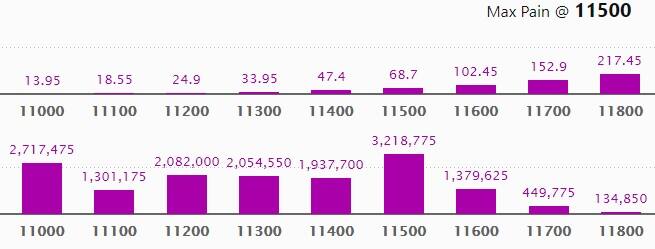

Put option data

Maximum Put open interest of 32.18 lakh contracts was seen at 11,500 strike, which will act as crucial support in the September series.

This is followed by 11,000 strike, which holds 27.17 lakh contracts, and 11,200 strike, which has accumulated 20.82 lakh contracts.

Put writing was seen at 11,500 strike, which added 10.85 lakh contracts, followed by 11,600 strike, which added 5.03 lakh contracts and 11,400 strike which added 2.17 lakh contracts.

Put unwinding was witnessed at 11,200, which shed 54,225 contracts, followed by 10,900 strike which shed 18,000 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

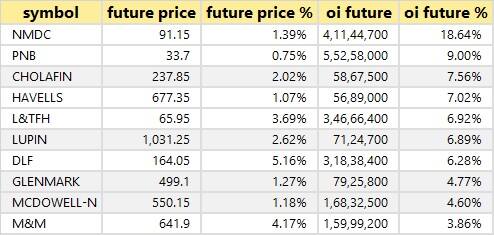

44 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

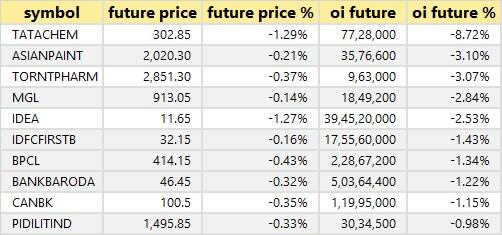

19 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

32 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

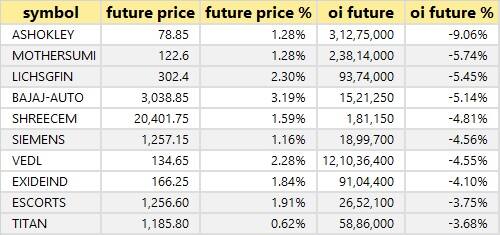

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Manaksia Steels: The company acquired 13,25,000 equity shares of Manaksia Limited through market purchase on September 16, raising shareholding from 4.08 percent to 6.10 percent.

Indian Energy Exchange: Dalmia Cement (Bharat) bought 70 lakh shares in the company at Rs 206.20 per share on the BSE. However, DPVL Ventures LLP was the seller for the same shares at the same price.

Elgi Rubber: Promoter Varadaraj Sudarsan acquired 4,75,345 equity shares in the company at Rs 16.68 per share on the NSE. However, P Chandrasekaran sold 4,72,300 shares at the same price.

(For more bulk deals, click here)

Analysts/Board Meetings

HSIL: The meeting of the board of directors of the company is scheduled for September 21 to consider the proposal of buyback of the fully paid-up equity shares.

Filatex India: The company's representatives will be attending a virtual investors' conference on September 18.

Trident: The company's representatives will be attending a virtual investors' conference on September 17.

Sanghvi Forging and Engineering: The company will consider unaudited financial results for the quarter ended June 30, 2020, on September 22.

Stocks in the news

HCL Technologies: The company and Google Cloud expanded partnership to deliver accelerated business intelligence platform.

Action Construction Equipment: ICRA assigned a long-term rating of AA- with a stable outlook to Rs 395 crore bank facilities of the company.

Genus Paper & Boards: SEBI imposed a penalty on three erstwhile promoters (including the company) of Genus Prime Infra for certain non-compliances of regulations.

GMR Infrastructure: Promoter entity GMR Enterprises created a pledge on 3.75 crore equity shares of the company.

B&A Packaging India: CRISIL upgraded the company's long term credit rating to BBB/Stable from BBB-/Stable and short term rating to A3+ from A3.

Dhanuka Agritech: The company approved the proposal of buyback of shares worth up to Rs 100 crore and fixed September 28 as record for determining the entitlement of equity shareholders.

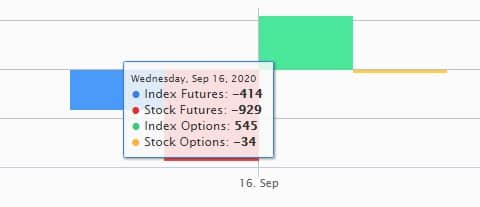

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 264.66 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 212.21 crore in the Indian equity market on September 16, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Eleven stocks -- Adani Enterprises, Aurobindo Pharma, Bank of Baroda, BHEL, Canara Bank, Escorts, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Tata Chemicals and Vedanta-- are under the F&O ban for September 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Comments

Post a Comment