Trade Setup for Friday / Stocks to Buy - Sell

Key support levels for the Nifty is placed at 11,527.43, followed by 11,495.67. If the index moves up, the key resistance levels to watch out for are 11,604.13 and 11,649.07.

The Indian market benchmarks ended flat with a positive bias, thus ending in the green for the fifth consecutive session, on August 27, amid mixed global cues.

Investors traded with caution on expiry day of the August F&O series. The Nifty ended with nominal gains despite opening above the 11,600 levels.

The Sensex closed 40 points, or 0.1 percent, higher at 39,113.47. The Nifty settled 10 points, or 0.08 percent, up at 11,559.25. The BSE Midcap index closed flat while the Smallcap index ended 0.35 percent higher.

"The market has been more or less listless in the last two sessions despite a rise in the domestic currency and decline in bond yields. Investors will be eyeing the Fed president's speech at the Jackson Hole Symposium. On August 28, the Nifty could look for support at 11,480 and 11,450 levels while 11,660-11,700 would be major hurdles. The strategy must be to purchase on dips with a final stop loss at 11,350," said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,527.43, followed by 11,495.67. If the index moves up, the key resistance levels to watch out for are 11,604.13 and 11,649.07.

Nifty Bank

Nifty Bank closed 0.80 percent higher at 23,600.35. The important pivot level, which will act as crucial support for the index, is placed at 23,474.96, followed by 23,349.63. On the upside, key resistance levels are placed at 23,714.86 and 23,829.43.

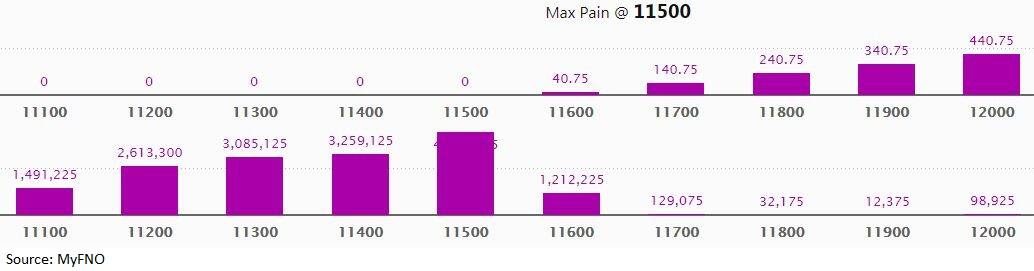

Call option data

Maximum Call OI of 57.5 lakh contracts was seen at 11,600 strike, which will act as crucial resistance in the September series.

This is followed by 11,700, which holds 45.52 lakh contracts, and 11,800 strikes, which has accumulated 26.10 lakh contracts.

Call writing was seen at 11,600, which added 24.09 lakh contracts, followed by 11,700, which added 14.45 lakh contracts.

Call unwinding was seen at 11,500, which shed 17.46 lakh contracts, followed by 11,400 strikes, which shed 5.65 lakh contracts.

Put option data

Maximum Put OI of 44.20 lakh contracts was seen at 11,500 strikes, which will act as crucial support in the September series.

This is followed by 11,400, which holds 32.59 lakh contracts, and 11,300 strikes, which has accumulated 30.85 lakh contracts.

Put writing was seen at 11,500, which added 4.32 lakh contracts, followed by 11,600, which added 3.76 lakh contracts.

Put unwinding was witnessed at 11,400, which shed 7.26 lakh contracts, followed by 11,200, which shed 3.8 lakh contracts.

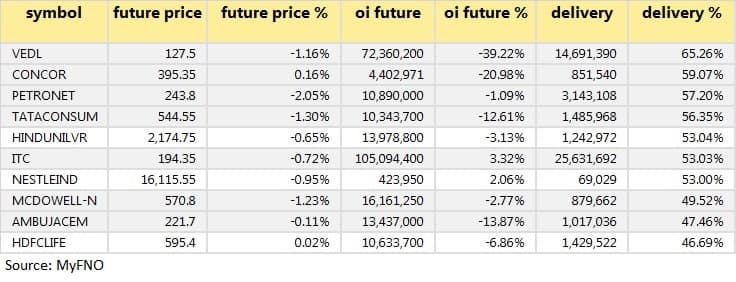

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

3 stocks saw long build-up

84 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

5 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions.

46 stocks saw short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the OI future percentage, here are the top 10 stocks in which short-covering was seen.

Rollovers

Bulk deals

Mehul Kanubhai Patel bought 1,79,39,973 shares of Banco Products India at an average price of Rs 97 per share through a bulk deal on the BSE. Overseas Pearl sold as many shares at the same average price.

Dhoot Instruments bought 1,25,500 shares of Dhoot Industrial Finance at an average price of Rs 27.50 per share via a bulk deal on the BSE. Aditya Birla Retail sold 1,23,339 shares of the company at the same average price.

Plutus Wealth Management bought 12,47,059 shares of Saint Gobain Sekurit India at an average price of Rs 65.71 per share through a bulk deal on the BSE.

Plutus Wealth Management bought 13,040 shares of Wendt (India) at an average price of Rs 3,800.12 per share via a bulk deal on the NSE.

Westbridge Crossover Fund sold 4,07,419 shares of CEAT at an average price of Rs 950 through a bulk deal on the NSE.

Castor Investments bought 1,40,000 shares of Sentinel Tea And Exports at an average price of Rs 61.13 per share through a bulk deal on the NSE. Secura India Trust also bought as many shares of the company at an average price of Rs 61.10.

Asian Markets Securities and Biyani Financial Services each bought 25,000 shares of Thejo Engineering at an average price of Rs 683.55 per share through a bulk deal on the NSE.

Porinju Veliyath-owned Equity Intelligence India bought 50,000 shares of Thejo Engineering at an average price of the Rs 675.11. India Opportunities Fund sold 1,71,400 shares of Thejo Engineering at an average price of Rs 679.81.

Results on August 28

Archies, Centum Electronics, GP Petroleums, Industrial Investment Trust, Inox Wind, Khadim India, Kohinoor Foods, Magnum Ventures, SJVN, Polytex India, etc.

Stocks in the news

NMDC: The company reported a 55 percent YoY decline in Q1 FY21 PAT at Rs 533 crore. Revenue from operations fell almost 41 percent YoY to Rs 1,937.50 crore.

GMR Infrastructure: Consolidated net loss for the June quarter more than doubled to nearly 834 crore against Rs 335 crore loss in the same quarter of FY20.

PNC Infratech: Q1 consolidated PAT declined 48 percent YoY to Rs 92 crore. Revenue declined 28 percent YoY to Rs 1,093 crore.

Mahindra & Mahindra: The company announced the introduction of the Marazzo with BS-VI technology.

Fund flow

FII and DII dataForeign institutional investors (FIIs) bought shares worth Rs 1,164.32 crore, whereas domestic institutional investors (DIIs) sold shares worth Rs 809.27 crore in the Indian equity market on August 27, as per provisional data available on the NSE.

Comments

Post a Comment