Monday Market Expectations, Must Read

The market closed a volatile session moderately higher on September 11 as India and China agreed on a five-point road map, including quick disengagement of troops and avoiding any action that could escalate tensions, to resolve the border standoff.

The Sensex gained 14.23 points to close at 38,854.55, while the Nifty50 rose 15.20 points to 11,464.50, forming a Doji pattern on the daily charts and climbed over a percent for the week to witness a bullish candle on the weekly scale after the formation of a significant Bearish Engulfing pattern in the previous week.

"The upside bounce of Thursday session is holding with range-bound action on Friday. Any upside attempt is limited up to 11,500-11,600 levels for the next week, but there is a higher chance of selling pressure emerging from the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

Until 11,600 level is crossed decisively on the upside, the near-term bearish trend status and the initial downside target of 11,000 remains intact for the market, he said.

The broader markets outperformed benchmark indices. The Nifty midcap index gained 0.7 percent and the smallcap was up 0.3 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not of the current month only.

Key support and resistance levels for the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,425.1 followed by 11,385.7. If the index moves up, the key resistance levels to watch out for are 11,498.7 and 11,532.9.

Nifty Bank

The Bank Nifty also ended moderately higher on September 11 with 13.80 points gains at 22,480. The important pivot level, which will act as crucial support for the index, is placed at 22,234.27, followed by 21,988.63. On the upside, key resistance levels are placed at 22,697.17 and 22,914.43.Call option data

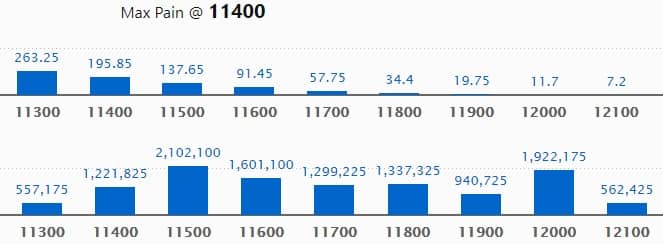

Maximum Call open interest of 21.02 lakh contracts was seen at 11,500 strike, which will act as a crucial resistance in the September series.

This is followed by 12,000 strike, which holds 19.22 lakh contracts, and 11,600 strike, which has accumulated 16.01 lakh contracts.

Call writing was seen at 12,000 strike, which added 2.01 lakh contracts, followed by 11,500, which added 1.85 lakh contracts, and 12,200 strike that added 1.63 lakh contracts.

Call unwinding was seen at 11,400 strike, which shed 1.02 lakh contracts, followed by 11,300 strike that shed 78,525 contracts.

Put option data

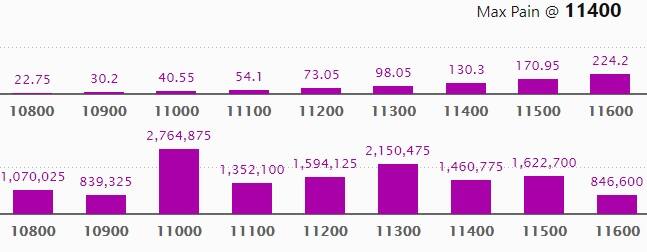

Maximum Put open interest of 27.64 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300 strike, which holds 21.5 lakh contracts, and 11,500 strike, which has accumulated 16.22 lakh contracts.

Put writing was seen at 11,300 strike, which added 2.58 lakh contracts, followed by 11,400 strike, which added 2.18 lakh contracts and 10,700 strike which added 1.43 lakh contracts.

Put unwinding was witnessed at 11,000, which shed 1.84 lakh contracts, followed by 12,000 strike which shed 9,450 contracts.

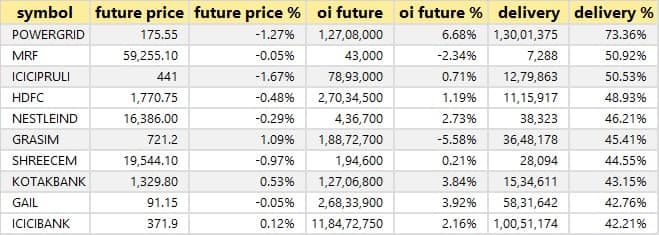

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

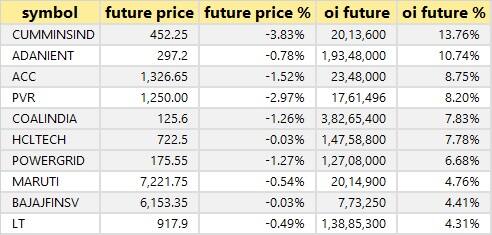

53 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

11 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

34 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Amber Enterprises: Vittoria Fund-OC LP bought 1,62,171 equity shares in the company at Rs 1,835.03 per share, Oxbow Master Fund 4,18,075 shares at Rs 1,835.03 per share, Newport Asia Partners Fund LP 1,73,979 shares at Rs 1,839.48 per share and Newport Asia Institutional Fund LP 2,21,857 shares at Rs 1,839.48 per share. However, Ascent Investment Holdings Pte sold 9,86,646 shares in the company at Rs 1,837.78 per share, Ascent Investment Holdings Pte 23,02,173 shares at Rs 1,835.14 per share, Kartar Singh 2,75,000 shares at Rs 1,841.33 per share on the NSE on September 11.

Jiya Eco-Products: Yogeshkumar C Patel sold 2,28,964 shares at Rs 8.89 per share on the NSE.

Suumaya Lifestyle: Gretex Share Broking sold 2 lakh shares in the company at Rs 31 per share on the NSE.

Max Healthcare Institute: Analjit Singh sold 58,18,021 shares in the company at Rs 110.70 per share on the BSE and Max Ventures Investment Holdings 4,07,50,158 shares at Rs 110.70 per share. However, WF Asian Reconnaissance Fund bought 77,00,000 shares at Rs 110.70 apiece and Smallcap World Fund Inc 2,37,77,803 shares at Rs 110.70 per share.

(For more bulk deals, click here)

Earnings on September 14

Apollo Hospitals Enterprise, Future Retail, HUDCO, PVR, Anant Raj, Ansal Properties, Asian Oilfield Services, Astra Microwave Products, AXISCADES Engineering, Balaji Telefilms, Bharat Road Network, GATI, HPL Electric & Power, IFCI, IVRCL, ITI, JB Chemicals, Jaypee Infratech, Jump Networks, Kwality, MBL Infrastructures, MMTC, NBCC (India), PC Jeweller, Raymond, SAIL, Skipper, SREI Infrastructure Finance and Take Solutions are among 443 companies to announce quarterly earnings on September 14.

Stocks in news

BHEL: The company reported a loss of Rs 893.1 crore in Q1FY21 against a Rs 218.9 crore loss. Revenue fell to Rs 1,990.9 crore versus Rs 4,532.5 crore YoY.

Goa Carbon: The company resumed operations at Paradeep unit.

BGR Energy Systems: The company reported a loss of Rs 74.42 crore in Q1FY21 against a loss of Rs 12.49 crore. Revenue fell to Rs 127.47 crore versus Rs 631.98 crore YoY.

UPL: LIC raised the stake in the company to 7.07 percent from 5.06 percent earlier.

Heritage Foods: The board approved to sell 1,78,47,420 equity shares of Future Retail and 8,92,371 equity shares of Praxis Homer Retail Limited held by the company in one or more tranches.

Jindal Stainless (Hisar): The company reported a loss at Rs 93.89 crore against a profit of Rs 105.3 crore; revenue declined to Rs 852.4 crore versus Rs 2,372 crore YoY.

Ratnamani Metals & Tubes: The company received a domestic order of Rs 90 crore for the supply of coated CS pipes for oil and gas sector to be completed between December 2020 and April 2021.

Eros International: The company reported a loss of Rs 28.49 crore in Q1FY21 against a profit of 27.05 crore. Revenue dropped to Rs 41.68 crore from Rs 183.52 crore YoY.

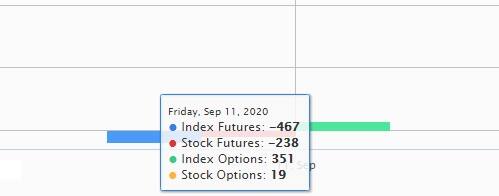

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,175.81 crore, whereas domestic institutional investors (DIIs) net offloaded shares worth Rs 724.31 crore in the Indian equity market on September 11, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Ten stocks—Adani Enterprises, Apollo Tyres, Bank of Baroda, BHEL, Canara Bank, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Punjab National Bank and Vedanta—are under the F&O ban for September 14. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Comments

Post a Comment