Trade Setup for Wednesday

A sustainable move above 11,600 could have further positive impact on the market, says Nagaraj Shetti of HDFC Securities.

The market gained strength after a day of correction and climbed higher on the back of positive global cues and rally in banking and IT stocks on September 15.

The BSE Sensex closed above 39,000 levels, up 287.72 points at 39,044.35, while the Nifty50 jumped 81.80 points to end above the crucial 11,500 mark, at 11,521.80 and formed a small bullish candle on the daily charts.

"After the formation of a negative candlestick pattern of Monday, Nifty showing upside bounce today could signal a possibility of a retest of the upside resistance around 11,570-11,600 levels in the short term. A sustainable move above 11,600 could have a further positive impact on the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"It is going to be crucial to watch market behaviour at the hurdle of 11,600. As long as the swing high of August 31 (11,794-high of Bearish Engulfing as per daily and weekly chart) is protected, the broad-based upside momentum could be muted in the near term," he said.

The broader markets continued to outshine benchmark indices as the Nifty Midcap index was up 1 percent and Smallcap rose 1.5 percent.

"We are seeing noticeable buying across the board during this consolidation phase and it is indeed a positive sign. However, the participation of the banking pack is critical for any directional move in the index. Consider the prevailing scenario, we suggest keeping a close watch on the outcome of the US Fed meet for cues," Ajit Mishra, VP - Research at Religare Broking said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,464, followed by 11,406.2. If the index moves up, the key resistance levels to watch out for are 11,557.8 and 11,593.8.

Nifty Bank

The Bank Nifty outperformed Nifty50, rising 364.40 points or 1.65 percent to 22,465.70. The important pivot level, which will act as crucial support for the index, is placed at 22,180.6, followed by 21,895.5. On the upside, key resistance levels are placed at 22,632.5 and 22,799.3.

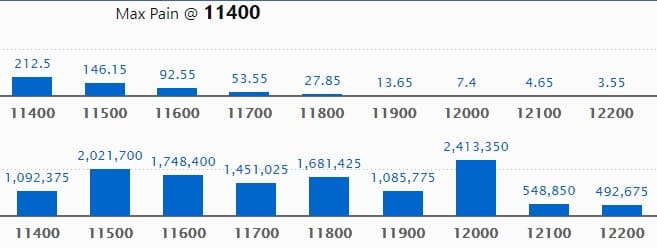

Call option data

Maximum Call open interest of 24.13 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the September series.

This is followed by 11,500 strike, which holds 20.21 lakh contracts, and 11,600 strike, which has accumulated 17.48 lakh contracts.

Call writing was seen at 12,000 strike, which added 3.88 lakh contracts, followed by 11,800, which added 1.63 lakh contracts, and 11,900 strike, which added 1.09 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 1.83 lakh contracts, followed by 11,400 strike, which shed 85,800 contracts.

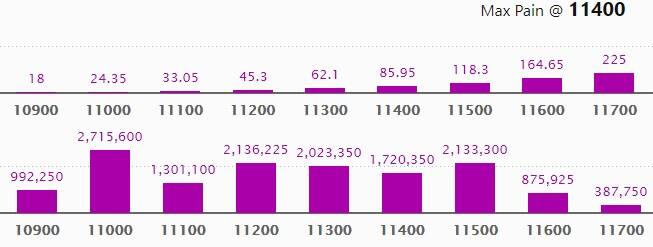

Put option data

Maximum Put open interest of 27.15 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,200 strike, which holds 21.36 lakh contracts, and 11,500 strike, which has accumulated 21.33 lakh contracts.

Put writing was seen at 11,500 strike, which added 2.01 lakh contracts, followed by 11,200 strike, which added 1.29 lakh contracts and 11,000 strike which added 72,600 contracts.

Put unwinding was witnessed at 11,100, which shed 37,425 contracts, followed by 11,900 strike which shed 24,000 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

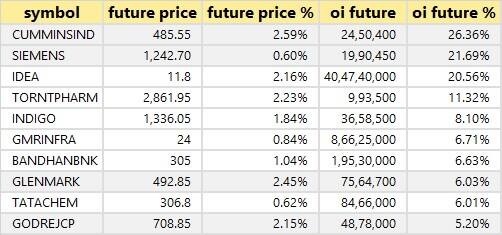

38 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

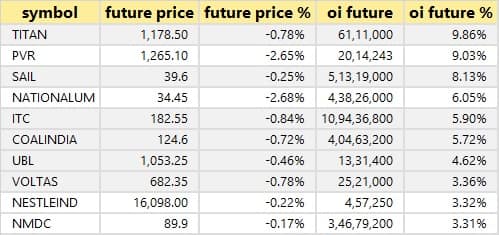

19 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

24 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

55 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

BSE Limited: Nippon India Mutual Fund A/C Nippon India Small Cap Fund acquired 5,46,650 equity shares in the company at Rs 554 per share on the NSE. However, Deutsche Boerse Aktiengesellschaft sold another 7,86,933 shares in the company at Rs 554.36 per share.

Hexaware Technologies: Societe Generale bought 15,25,000 shares in the IT company at Rs 443.01 per share on the NSE.

Max India: Rajasthan Global Securities bought 3,83,071 shares in the company at Rs 66.41 per share on the NSE.

Shilpa Medicare: Barclays Merchant Bank Singapore sold 4,93,893 shares in the company at Rs 560.21 per share on the NSE.

Waterbase: KCT Management Services acquired 3,25,000 shares in the company at Rs 105 per share on the BSE.

(For more bulk deals, click here)

Analysts/Board Meetings

Infosys: Company is scheduled to meet on October 14 to consider September quarter 2020 earnings.

Heidelberg Cement India: The company's representatives - Jamshed Naval Cooper, Managing Director; Anil Sharma, CFO and Amit Angra, VP - Finance will have an online meeting with the representatives of Plutus Wealth Management LLP on September 16.

Mahanagar Gas: Ventura Securities will have a conference call with the company on September 18.

Stocks in the news

SpiceJet: The company reported a loss of Rs 600.5 crore in Q1FY21 against a profit of Rs 262.8 crore, revenue fell to Rs 521 crore versus Rs 3002.8 crore YoY.

Uflex: Promoter entity Flex International released 2.7 lakh pledged shares.

Infosys: US-based Essential Utilities selected Infosys as a strategic partner to drive its digital transformation.

REC: The company to infuse Rs 150 crore as equity in a Joint Venture alongwith Power Finance Corporation, Power Grid Corporation and NTPC, for the purpose of establishment/creation of Common Backend Infrastructure Facility (CBIF) for smart metres in the country.

Power Mech Projects: The company reported a loss of Rs 32.69 crore in Q1FY21 against a profit of Rs 28 crore, revenue dropped to Rs 275 crore from Rs 491 crore YoY.

Aurobindo Pharma: Biotechnology Industry Research Assistance Council (BIRAC), set up by Department of Biotechnology (DBT), Government of India supported Aurobindo's COVID-19 vaccine development under the National Biopharma Mission.

Siti Networks: The company approved acquisition of 51 percent equity stake in E-Net Entertainment, through the wholly owned subsidiary namely Siti Broadband Services.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,170.89 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 895.63 crore in the Indian equity market on September 15, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Ten stocks -- Adani Enterprises, Bank of Baroda, BHEL, Canara Bank, Escorts, Indiabulls Housing Finance, Vodafone Idea, Jindal Steel & Power, Tata Chemicals and Vedanta-- are under the F&O ban for September 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Comments

Post a Comment