Tuesday's Market Expectations, Must Read

According to pivot charts, the key support levels for the Nifty are placed at 11,359.37, followed by 11,278.73

The market started off on a strong note on September 14, but erased all gains in the last couple of hours of trade due to selling in banking and financials and select FMCG stocks. But strong buying in technology stocks after management commentary from HCL Technologies capped the downside.

The Sensex corrected 97.92 points to 38,756.63 and the Nifty fell 24.50 points to 11,440, forming a bearish candle on the daily charts.

"Technically, this indicates a formation of a Bearish Dark Cloud Cover or counter attack bear candle pattern at the highs. A formation of such patterns after a reasonable up move or near the crucial overhead resistance could signal probability of profit booking from the highs or a reversal pattern," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

The key upside area of 11,500-11,550 (previous swing high and the opening downside gap of September 4) has acted as a strong overhead resistance and led to a sharp intraday weakness from the highs. This is a negative indication, he added.However, the broader markets smartly outperformed benchmark indices, with the Nifty Midcap and Smallcap indices rising 2.6 percent and 5.4 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 11,359.37, followed by 11,278.73. If the index moves up, the key resistance levels to watch out for are 11,544.77 and 11,649.53.

Nifty BankThe fall in Bank Nifty was higher than the Nifty, correcting 378.65 points, or 1.68 percent, to 22,101.30. The important pivot level, which will act as crucial support for the index, is placed at 21,833.84, followed by 21,566.47. On the upside, key resistance levels are placed at 22,562.94 and 23,024.67.

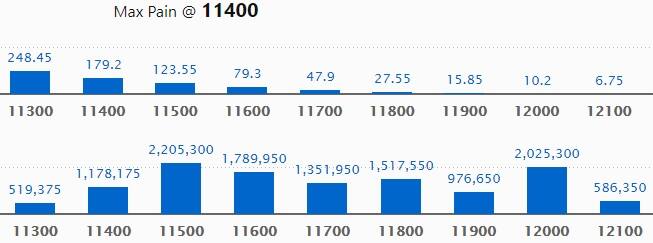

Call option dataMaximum Call OI of 22.05 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the September series.

This is followed by 12,000, which holds 20.25 lakh contracts, and 11,600 strikes, which has accumulated 17.89 lakh contracts.

Call writing was seen at 11,600, which added 1.88 lakh contracts, followed by 11,800, which added 1.8 lakh contracts, and 11,500 strikes, which added 1.03 lakh contracts.

Call unwinding was seen at 11,400, which shed 43,650 contracts, followed by 11,300 strikes, which shed 37,800 contracts.

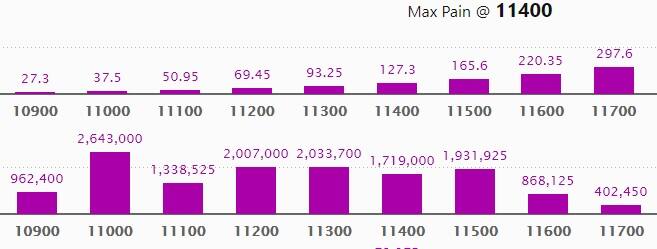

Put option data

Maximum Put OI of 26.43 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,300, which holds 20.33 lakh contracts, and 11,200 strikes, which has accumulated 20.07 lakh contracts.

Put writing was seen at 11,200, which added 4.12 lakh contracts, followed by 11,500, which added 3.09 lakh contracts, and 11,400 strikes, which added 2.58 lakh contracts.

Put unwinding was witnessed at 11,000, which shed 1.2 lakh contracts, followed by 11,300 strikes, which shed 1.16 lakh contracts.

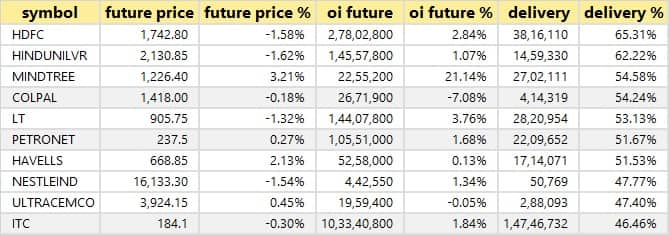

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

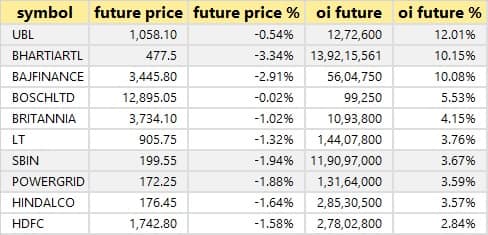

34 stocks saw long build-up

Based on the OI future percentage, here are the top 10 stocks in which long build-up was seen.

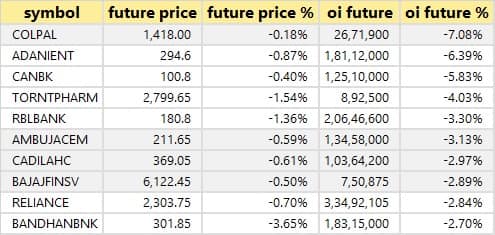

30 stocks saw long unwinding

Based on the OI future percentage, here are the top 10 stocks in which long unwinding was seen.

33 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 10 stocks in which short build-up was seen.

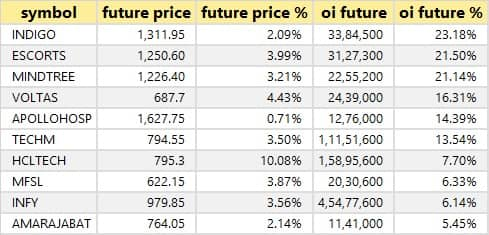

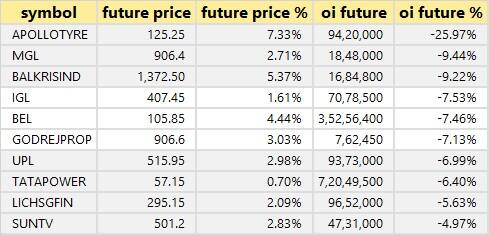

40 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates short-covering. Based on OI future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

ADF Foods: Ashish Ramchandra Kacholia acquired 1,48,871 equity shares in the company at Rs 377.99 per share on the NSE.

BASF: Plutus Wealth Management bought 3.1 lakh shares in the company at Rs 1,545.83 per share.

BSE: Acacia Conservation Fund (Ruanne Cunniff), Acacia Banyan Partners (Ruanne Cunniff and Gold Farb) and Ruanne Cunniff and Gold Farb Inc A/C Acacia Institutional Partners acquired 5,06,999, 2,42,381, and 2,92,010 shares, respectively, at Rs 549 per share. Deutsche Boerse Aktiengesellschaft sold 12 lakh shares in company at the same price.

Greenply Industries: Jwalamukhi Investment Holdings offloaded 7,13,108 shares in the company at Rs 90.5 per share.

Oswal Chemicals and Fertilisers: Clareville Capital Opportunities Master Fund sold 43,36,635 shares at Rs 11.95 per share. Alliance Techno Projects was the buyer of those shares.

Satin Credit Network: Manglam Financial Services acquired 2,95,000 shares in the company at Rs 64.5 per share. Kora Investments I sold 22,30,207 shares at Rs 64.18 per share.

Suumaya Lifestyle: Gretex Share Broking sold 2 lakh shares in the company at Rs 31 per share.

Tata Elxsi: William Blair International Growth Fund acquired 3,12,485 shares in the company at Rs 1,304 per share.

(For more bulk deals, click here)

Earnings on September 15

Vedanta, SpiceJet, Max India, Alankit, Allcargo Logistics, ARSS Infrastructure Projects, DB Realty, Future Enterprises, Gammon India, Hubtown, Indo Tech Transformers, ITD Cementation India, Jain Irrigation Systems, Kalyani Forge, Kilitch Drugs, Liberty Shoes, Manpasand Beverages, MEP Infrastructure Developers, Mercator, MTNL, National Fertilisers, Omkar Speciality Chemicals, Peninsula Land, Procter & Gamble Health, Power Mech Projects, Rolta India, RPP Infra Projects, Sakthi Sugars, Steel Strips Wheels, Sterling and Wilson Solar, Texmo Pipes & Products, Tilaknagar Industries, VA Tech Wabag and Zee Media Corporation are among over 600 companies to announce quarterly earnings on September 15.

Stocks in the news

Zensar Technologies launches blockchain-based contract management solution for companies.

Omaxe reported a loss of Rs 63.9 crore in Q1 FY21 against a profit of Rs 14.9 crore, revenue dropped to Rs 50.7 crore versus Rs 353 crore YoY.

Mirza International reported a loss of Rs 23.23 crore in Q1 FY21 against a profit of Rs 9.5 crore, revenue fell to Rs 83.1 crore versus Rs 308 crore YoY.

Repro India reported a loss of Rs 17 crore in Q1 FY21 against a profit of Rs 6.9 crore, revenue dropped to Rs 20.3 crore from Rs 107 crore YoY.

Munjal Auto Industries reported a loss of Rs 11.30 crore in Q1 FY21 against a profit of Rs 4.3 crore, revenue declined to Rs 212.7 crore versus Rs 301 crore YoY.

SREI Infrastructure Finance reported a profit of Rs 23 crore in Q1 FY21 against a profit of Rs 42.67 crore, revenue fell to Rs 1,188.6 crore against Rs 1,582.6 crore YoY.

HUDCO reported a profit of Rs 203.4 crore in Q1 FY21 against a profit of Rs 335.6 crore, revenue declined to Rs 1,773.9 crore from Rs 1,806.5 crore YoY.

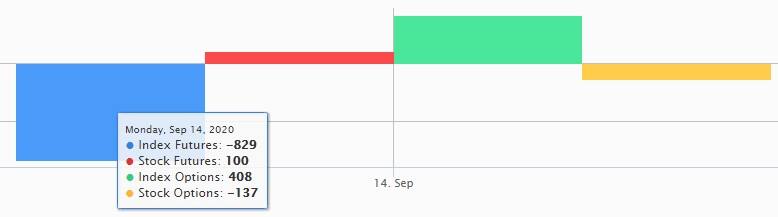

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 298.22 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 120.35 crore in the Indian equity market on September 14, as per provisional data available on the NSE.

Stock under F&O ban on NSEEight stocks -- Adani Enterprises, Bank of Baroda, BHEL, Canara Bank, Escorts, Indiabulls Housing Finance, Jindal Steel & Power and Vedanta -- are under the F&O ban for September 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Comments

Post a Comment